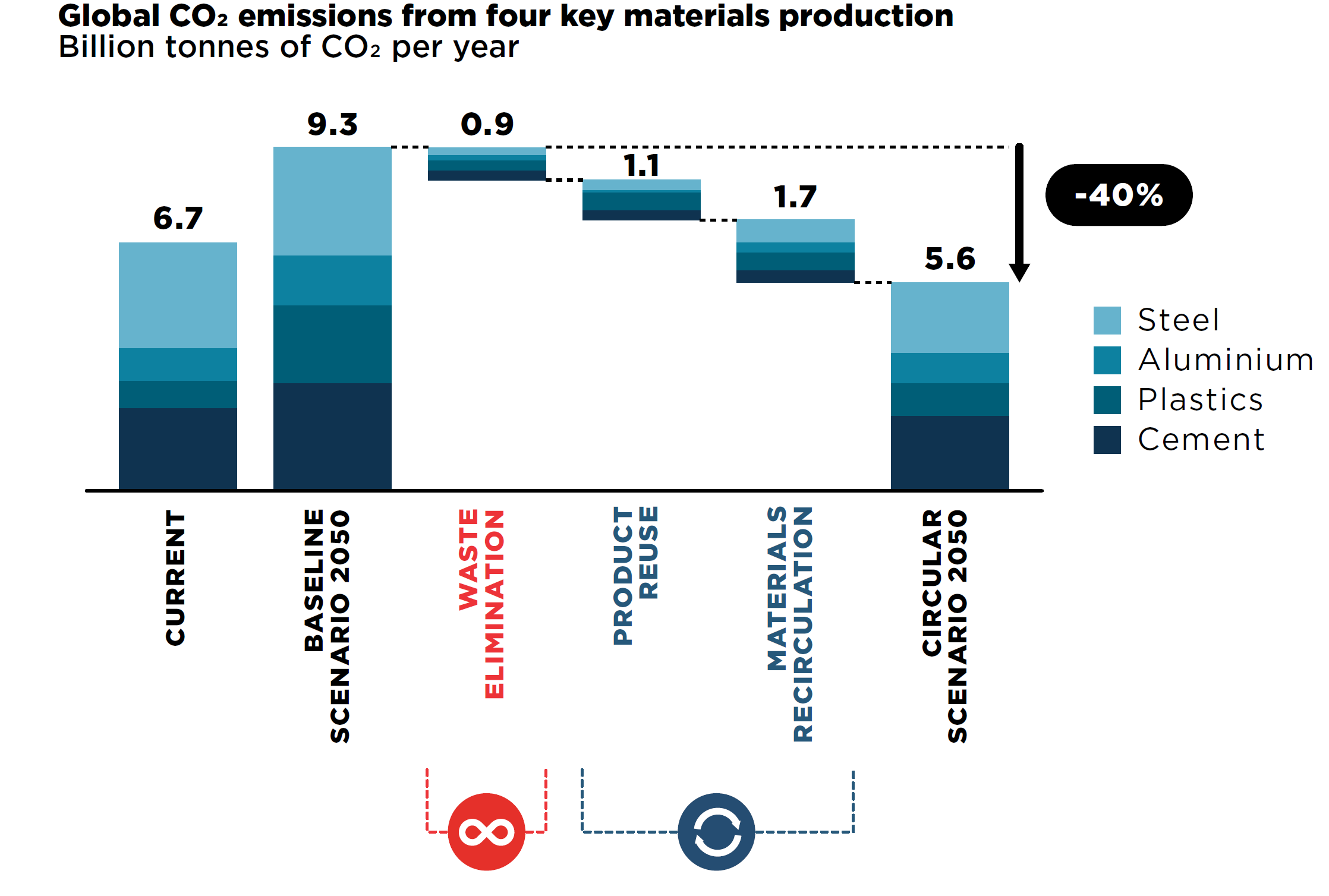

Oftentimes, ‘the climate’ and ‘the circular economy’ are presented as two different policy agendas – two agendas that have to fight for attention, and even money. This fight is happening in a world that needs to transition to a circular economy if we are to meet the goals of the Paris agreement. Today, at least 45% of global CO2 emissions come from our ‘stuff’, according to a fundamental report recently released by the Ellen MacArthur Foundation. Of course, we need to make efforts toward the energy and mobility transition, but that’s not enough. Staying within the warming limit of 1.5˚C will require the decarbonization of our energy system by 11.3% a year – that is 700% faster than the current rate (EMF, 2019).

Source: Ellen MacArthur Foundation, Completing the Picture: How the Circular Economy Tackles Climate Change (2019)

The report distinguishes between three different circular strategies that can contribute to achieving our climate goals:

• Eliminating waste in our design process

• Keeping products and materials ‘in the cycle’

• Regenerating natural systems

Applied to industry alone, these strategies would lead to an annual global reduction of 3.7 billion tons of CO2 – the equivalent of the annual emissions of 80% of the cars in the world (!). There’s a reason that State Secretary van Veldhoven has asserted for some time that “… the circular economy is the missing piece of our climate challenge puzzle.”

Looking at the momentum we have in the Netherlands, in one respect I’m happy: a lot has happened in the eleven years since I led my first circular project, and there is an incredible number of start-ups and pilots. But as I heard creative leader and fellow sustainability advocate Livia Tironesay recently: “Pilots are alibis, and alibis don’t scale.” (credits: Livia Tirone).

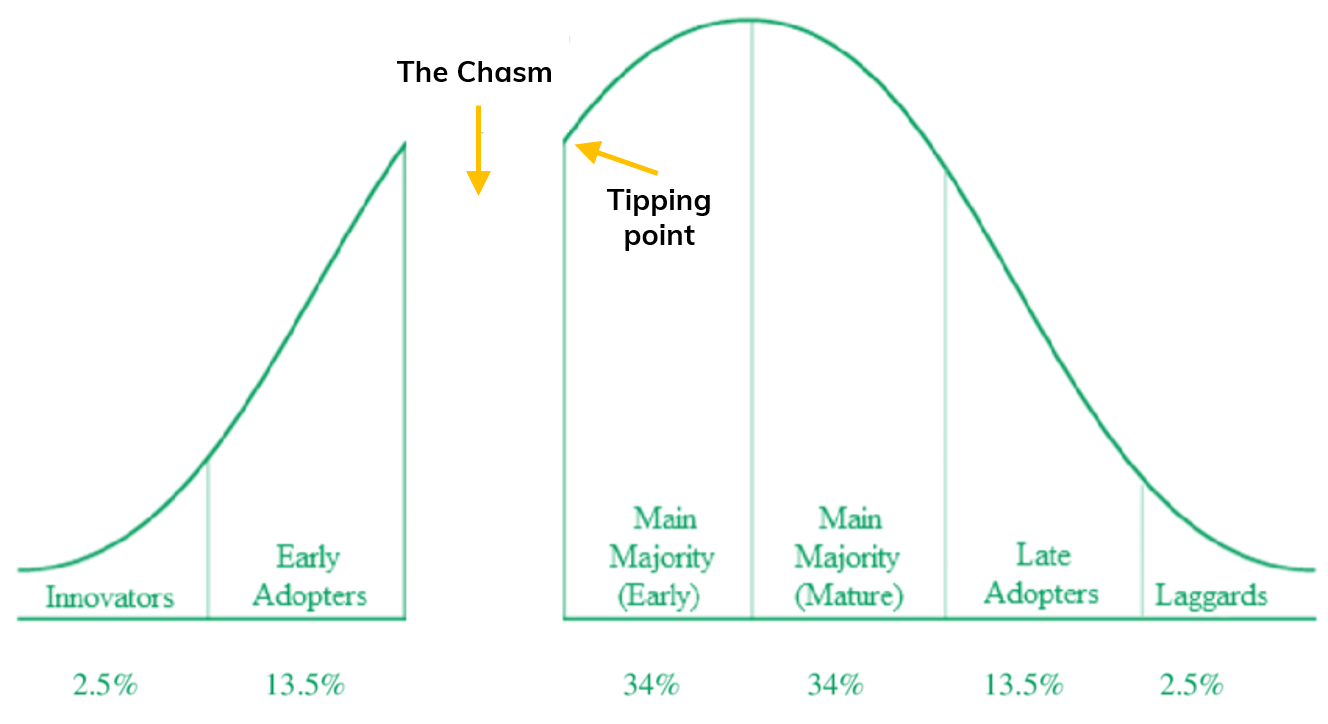

Source: Perkins (2015) op basis van Roger (1962), Moore (2002) en Gladwell (2000)

When discussing this with start-ups and larger organizations that want to scale, it becomes clear that the challenge is often the restrictive business case. Yes, they want to invest in circularity, but there is a limit. In the circular economy we stand for the figurative “chasm”: on the left side of the cliff there are organizations that have experimented as if their lives depended on it and on the right side of that narrow gap lies that “promised land” where we can make circular mainstream.

We need a bridge, and to build one, I want to draw attention to the economic rules that are causing friction with our ambition – and the necessity! – of a circular economy.

One of the things in the Ellen MacArthur Foundation report that stands out is that circular revenue models are considered a means to keep products in the cycle longer. Yet today, the demand for circular revenue models is still pretty low – they are seen as idealistic, not realistic. Why? Because the current economic rules usually ensure that linear business is more economically attractive than circular business.

Over the past year, we have been investigating some of these economic barriers, and thankfully, others have also gathered some insights. Here I will outline, in random order, five things we must reconsider in order to make circular business and revenue models attractive:

- Depreciation rules: through depreciation, we reduce the perceived value of products; conversely, the circular economy is about the ‘value retention’ of our products and materials. Depreciation periods are also set for certain product groups, and this can further shorten the depreciation periods of rent, lease or pay-per-use contracts – according to accounting rules, only 75% of the lifespan of a product can be used in marketing such a revenue model.

- Double VAT on secondary raw materials: we want a circular economy, but why should organizations that use secondary raw materials have to pay VAT again on something that has already been taxed once? This is also connected to the next point.

- Taxing raw materials instead of labor: in the current economy (which is based on the empty world) we place a higher tax on labor than on raw materials. We need that labor to maintain, repair and remake our products, and with substantial labor costs, it is difficult for circular products to compete with the ‘new’ ones rolling off the production lines. In the wise words of architect Walter Stahel, labor is a ‘renewable raw material’, and you don’t want to (heavily) tax renewable raw materials. What you do want to tax, however, is emissions and the use of non-renewable, virgin raw materials. What the circular economy needs is something known as Ex’tax thinking – it’s been discussed enough, now it’s time to put it into action!

- VAT on hire-purchase models: when a product is put on the market as a ‘hire-purchase’ product, the supplier has to pay VAT on the entire purchase value, while in income they only receive the VAT the customer pays on their first payment term. The hire-purchase model is a sympathetic way to introduce anxious consumers to the idea of ‘use’ instead of ‘ownership’, but it can lead to enormous liquidity problems for the supplier, especially when it’s a start-up introducing the model.

- IFRS 16 regulation: since 1 January 2020, it has been compulsory for both the lessor and the lessee to include products valued at over $5,000 in their bookkeeping. This significantly undermines the idea that lease models are the key to a circular economy, because like this, a lease model puts an enormous burden on the books of both supplier or financier and user.

When today’s economic rules were created, the world was still relatively unpopulated, and it seemed resources would be endlessly at our disposal. The world has changed, but the rules have stayed the same. If we want a circular economy, if we want to stay within 1.5˚C, the time for experimenting is over; it is time to scale up. To do that, we must dare to really look at those big economic rules and to rethink them. It is called the circular economy after all.